QuickLinks-- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of

the

The Securities Exchange Act of 1934 (Amendment No. ) |

| | | | | | |

| Filed by the Registrantý | |

| Filed by a Party other than the Registranto | |

| Check the appropriate box: | |

o |

o |

| Preliminary Proxy Statement | |

o |

o |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý |

ý |

| Definitive Proxy Statement | |

o |

o |

| Definitive Additional Materials | |

o |

o |

| Soliciting Material under §240.14a-12

|

| | | | |

| | | | | | |

| Kratos Defense & Security Solutions, Inc. | |

| (Name of Registrant as Specified In Its Charter) | |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): | |

ý |

ý |

| No fee required. | |

o |

o |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| | | (1) | | Title of each class of securities to which transaction applies:

| |

| | | (2) | | Aggregate number of securities to which transaction applies:

| |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |

| | | (4) | | Proposed maximum aggregate value of transaction:

| |

| | | (5) | | Total fee paid:

| |

o |

o |

| Fee paid previously with preliminary materials. | |

o |

o |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

|

|

(1) |

(1) |

| Amount Previously Paid:

| |

| | | (2) | | Form, Schedule or Registration Statement No.:

| |

| | | (3) | | Filing Party:

| |

| | | (4) | | Date Filed:

| |

April 14, 2017

24, 2020

You are cordially invited to attend the

20172020 Annual Meeting of Kratos Defense & Security Solutions, Inc. ("Kratos"), which will be held

in person at the

Irvine Amenities Center locatedSkirvin Hilton at

9540 Towne Centre Drive, Suite 175, San Diego, California 92121,1 Park Avenue, Oklahoma City, OK 73102 and virtually at www.virtualshareholdermeeting.com/KTOS2020, on

Wednesday, May 31, 2017,Thursday, June 4, 2020, at

9:11:00 a.m.

local time.CDT. We hope you will be able to attend the meeting in person.

However, as a result of the ongoing global coronavirus (COVID-19) crisis, it may not be possible or advisable to hold our Annual Meeting in person at the current location, and we may have to hold our 2020 Annual Meeting at an alternative location or conduct the meeting solely by means of remote communication. If such a change is required, we will endeavor to communicate this as soon as possible.

At our annual meeting, our stockholders will be asked to elect the

eightseven directors named herein to our Board of Directors; to ratify the

Board'sBoard of Directors' selection of Deloitte & Touche LLP as our independent registered public accounting firm;

to approve an amendment to our 1999 Employee Stock Purchase Plan to increase the number of shares issuable under the plan by 3,000,000 shares; to approve an amendment to our 2014 Equity Incentive Plan to increase the number of shares issuable under the plan by

2,500,0004,700,000 shares; to cast an

advisory vote to approve the compensation of our named executive officers; to cast an advisory vote on the frequency of the stockholder advisory vote to approve the compensation of our named executive officers; and to transact such other business as may properly come before the meeting or any adjournment

or postponement thereof. Following the formal annual meeting, we will also present a report on our operations and activities, and management will be pleased to answer your questions about us and our business.

Whether or not you plan to attend the annual meeting personally, and regardless of the number of shares of Kratos common stock you own, it is important that your shares be represented at the annual meeting. This year, we are pleased to take advantage of rules enacted by the Securities and Exchange Commission

("SEC") that allow companies to furnish their proxy materials over the Internet. As a result, we are mailing to most of our stockholders a Notice of Internet Availability of Proxy Materials (the "Notice") instead of a paper copy of our proxy materials, which include the Notice of Annual Meeting of Stockholders, our proxy statement, our

20162019 Annual Report and a proxy card or voting instruction form. The Notice contains instructions on how to access those documents on the Internet and how to cast your vote via the Internet or by telephone. The Notice also contains instructions on how to request a paper copy of our proxy materials. All stockholders who do not receive the Notice will receive a paper copy of the proxy materials by mail. If you have received a paper copy of our proxy materials you can cast your vote by completing the enclosed proxy card and returning it in the postage-prepaid envelope provided or by utilizing the telephone or Internet voting systems.

|

| | |

| | | Sincerely, |

|

|

|

| | | Sincerely, |

| | |

| | Eric DeMarco

President and Chief Executive Officer |

KRATOS DEFENSE & SECURITY SOLUTIONS, INC.

4820 EASTGATE MALL,

10680 TREENA STREET, SUITE 200

600

SAN DIEGO, CA 92121

92131

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on May 31, 2017June 4, 2020 To the Stockholders of Kratos Defense & Security Solutions, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Kratos Defense & Security Solutions, Inc. (the "Company") will be held on

Wednesday, May 31, 2017,Thursday, June 4, 2020, at

9:11:00 a.m.

local timeCDT, in person at the

Irvine Amenities Center locatedSkirvin Hilton at

9540 Towne Centre Drive, Suite 175, San Diego, California 921211 Park Avenue, Oklahoma City, OK 73102 and virtually at www.virtualshareholdermeeting.com/KTOS2020, for the following purposes:

1.To elect the following eight nominees as directors to serve until the next annual meeting, or until their successors are duly elected and qualified: Scott Anderson, Bandel Carano, Eric DeMarco, William Hoglund, Scot Jarvis, Jane Judd, Samuel Liberatore, and Amy Zegart.

2.To ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017.

3.To approve an amendment to our 1999 Employee Stock Purchase Plan to increase the number of shares issuable under the plan by 3,000,000 shares.

4.To approve an amendment to our 2014 Equity Incentive Plan to increase the number of shares issuable under the plan by 2,500,000 shares.

5.An advisory (non-binding) vote to approve the compensation of our named executive officers, as presented in the proxy statement accompanying this Notice.

6.An advisory (non-binding) vote on the frequency of the stockholder advisory vote to approve the compensation of our named executive officers, as presented in the proxy statement accompanying this Notice.

7.To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

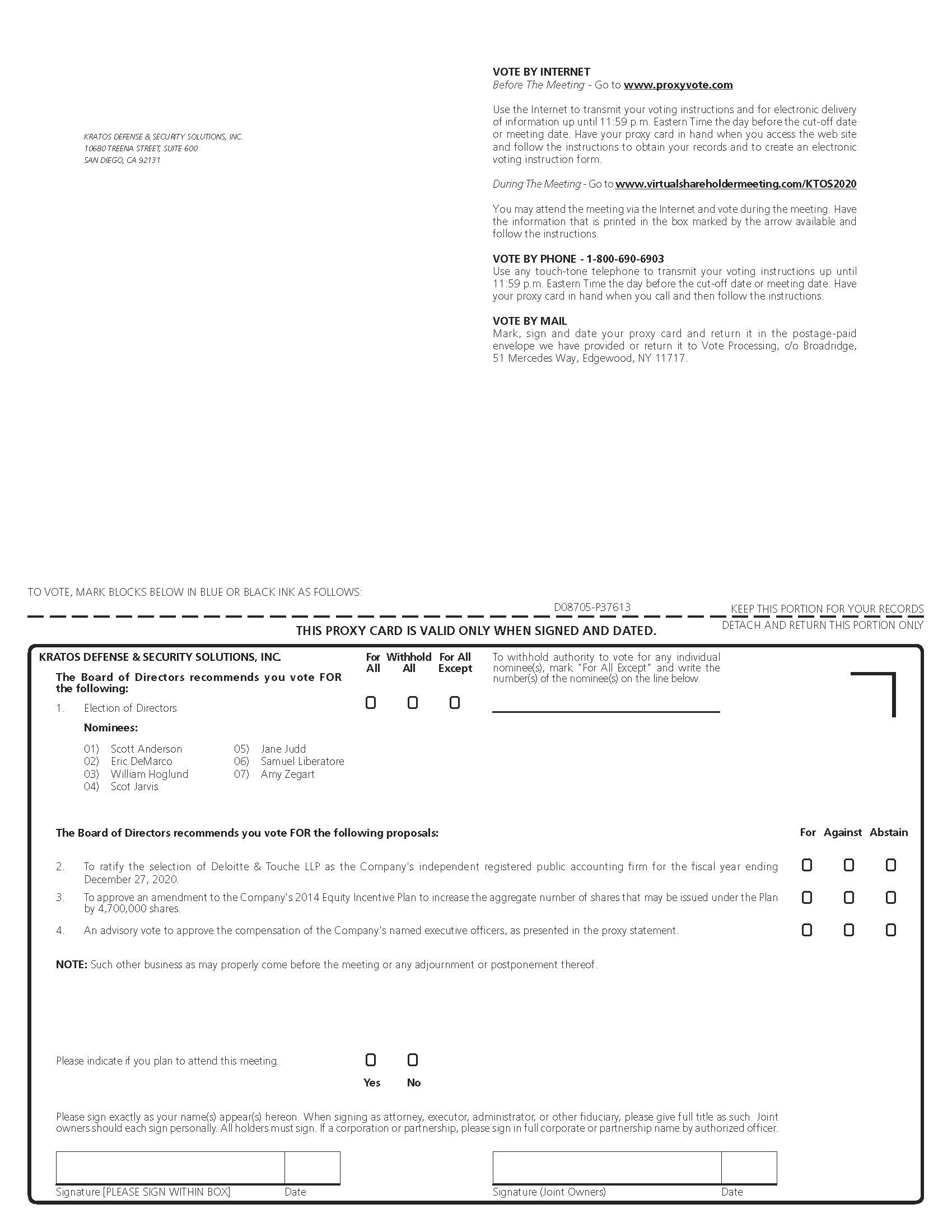

| |

| 1. | To elect the following seven nominees as directors to serve until the next annual meeting, or until their successors are duly elected and qualified: Scott Anderson, Eric DeMarco, William Hoglund, Scot Jarvis, Jane Judd, Samuel Liberatore, and Amy Zegart. |

| |

| 2. | To ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 27, 2020. |

| |

| 3. | To approve an amendment to our 2014 Equity Incentive Plan to increase the number of shares issuable under the plan by 4,700,000 shares. |

| |

| 4. | An advisory (non-binding) vote to approve the compensation of our named executive officers, as presented in the proxy statement accompanying this Notice. |

| |

| 5. | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

Our Board of Directors unanimously recommends a vote "FOR" the election of all of the director nominees, and "FOR" each of proposals 2, 3, 4, and 5, and "FOR" holding the advisory vote on executive compensation every "ONE YEAR" with respect to proposal 6.4. The foregoing items of business are more fully described in the proxy statement accompanying this Notice. Our Board of Directors has fixed the close of business on April 7, 20176, 2020 as the record date for the determination of stockholders entitled to notice of and to vote at this annual meeting and at any adjournment or postponement thereof. All stockholders are invited to attend the meeting. YouTo attend in person, you must present your proxy, voter instruction card or meeting notice for admission. If you plan to attend the meeting virtually, to participate you must access the virtual meeting at www.virtualshareholdermeeting.com/KTOS2020 and use the multi-digit Control Number provided with your proxy materials.

We intend to hold our annual meeting in person and virtually. However, we are actively monitoring the coronavirus (COVID-19) pandemic; we are sensitive to the public health and travel concerns our shareholders may have and the protocols that federal, state, and local governments may impose. In the event it is not possible or advisable to hold our annual meeting in person at the current location, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting at an alternative location or holding the meeting solely by means of remote communication. If we take this step, we will announce the decision to do so and provide information regarding how to participate in the annual meeting via a press release that will be posted on the “Investors” section of our website at www.kratosdefense.com and filed with the Securities and Exchange Commission as additional proxy materials. If you are planning to attend our meeting, please check the website one week prior to the meeting date. As always, we encourage you to vote your shares prior to the annual meeting.

|

| | |

| | By Order of the Board of Directors, |

| |

Eric DeMarco

|

April 14, 2017

| | Eric DeMarco |

| April 24, 2020 | | President and Chief Executive Officer |

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON.PERSON OR VIRTUALLY. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY OR VOTE OVER THE INTERNET OR BY TELEPHONE AS INSTRUCTED IN THESE MATERIALS AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING. Important Notice Regarding the Availability of Proxy Materials for the StockholderStockholders Meeting to Be Held on May 31, 2017:June 4, 2020: Our Notice of Annual Meeting of Stockholders, proxy statement and 20162019 Annual Report on Form 10-K are available at www.proxyvote.com.

(This page has been left blank intentionally)

2017

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

Annual Meeting of Stockholders

|

| | |

| Time & Date: | | 9:11:00 a.m., May 31, 2017 CDT, June 4, 2020 |

Place: |

| Skirvin Hilton 1 Park Avenue Oklahoma City, OK 73102

Irvine Amenities CenterMeeting live via the Internet at www.virtualshareholdermeeting.com/KTOS2020. You will need to have the multi-digit Control Number provided in your proxy materials to access the virtual meeting.

9540 Towne Centre Drive, Suite 175

San Diego, CA 92121

|

Record Date: |

|

April 7, 20176, 2020 |

Voting: |

|

You may vote either in person at the Annual Meeting, during the Annual Meeting at www.virtualshareholdermeeting.com/KTOS2020, or by telephone, the Internet or mail. See the section entitled "How to Vote" below for more detailed information regarding how you may vote your shares. |

Admission: |

|

Everyone attending the Annual Meeting will be required to present both proof of ownership of the Company's common stock and a valid picture identification, such as a driver's license or passport. If your shares are held in the name of a bank, broker or other financial institution, you will need a recent brokerage statement or letter from such entity reflecting your stock ownership as of the record date. If you do not have both proof of ownership of the Company's common stock and a valid picture identification, you may be denied admission to the Annual Meeting. If you attend the virtual meeting, you will need to have the multi-digit Control Number to participate. Cameras and electronic recording devices are not permitted at the Annual Meeting. |

| Potential Impact of COVID-19: | | We intend to hold the Annual Meeting in person and virtually. However, we are actively monitoring the coronavirus (COVID-19) pandemic; we are sensitive to the public health and travel concerns our shareholders may have and the protocols that federal, state, and local governments may impose. In the event it is not possible or advisable to hold the Annual Meeting in person at the current location, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting at an alternative location or holding the meeting solely by means of remote communication. If we take this step, we will announce the decision to do so and provide information regarding how to participate in the Annual Meeting via a press release that will be posted on the “Investors” section of our website at www.kratosdefense.com and filed with the SEC as additional proxy materials. |

Meeting Agenda and Voting Recommendations

| | Proposal | Proposal | | Board of Directors Vote Recommendation | | Page References

(for more detail) | Proposal | Board of Directors Vote Recommendation | | Page References (for more detail) |

|---|

| 1. | | Election of Directors | | FOR EACH DIRECTOR NOMINEE | | 19 | Election of Directors | FOR EACH DIRECTOR NOMINEE | | 19 |

| | | |

2. |

|

Ratification of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017 |

|

FOR |

|

23 | Ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 27, 2020 | FOR | | 22 |

| | | |

3. |

|

Approval of an amendment to our 1999 Employee Stock Purchase Plan to increase the number of shares issuable under the plan by 3,000,000 shares |

|

FOR |

|

25 | Approval of an amendment to our 2014 Equity Incentive Plan to increase the number of shares issuable under the plan by 4,700,000 shares

| FOR | | 24 |

| | | |

4. |

|

Approval of an amendment to our 2014 Equity Incentive Plan to increase the number of shares issuable under the plan by 2,500,000 shares |

|

FOR |

|

29 | Advisory (non-binding) vote to approve the compensation of our named executive officers | FOR | | 33 |

5. |

|

Advisory (non-binding) vote to approve the compensation of our named executive officers |

|

FOR |

|

41 | |

6. |

|

Advisory (non-binding) vote on the frequency of the stockholder advisory vote on the compensation of our named executive officers |

|

FOR 1 YEAR |

|

46 | |

Proposal 1: Director Nominees

The following table provides summary information about each director nominee. Each director nominee will be elected to serve until the next annual meeting of stockholders.

| | Name | | Age | | Director

Since | | Occupation | | Independent | | Committees | | Age | | Director Since | | Occupation | | Independent | | Committees |

|---|

| Scott Anderson | | 58 | | 1997 | | President, NE Wireless Networks, LLC | | x | | Audit (Chair); Nominating & Corporate Governance | | 61 | | 1997 | | President, NE Wireless Networks, LLC | | x | | Audit (Chair); Nominating & Corporate Governance |

Bandel Carano |

|

55 |

|

1998 |

|

Managing Partner, Oak Investment Partners |

|

x |

|

Compensation | |

Eric DeMarco |

|

53 |

|

2003 |

|

President and Chief Executive Officer, Kratos |

|

|

|

| | 56 | | 2003 | | President and Chief Executive Officer, Kratos | | | | |

William Hoglund (Chairman) |

|

63 |

|

2001 |

|

Member, Safeboats International, LLP |

|

x |

|

Audit; Compensation; Nominating & Corporate Governance | | 66 | | 2001 | | Member, Safeboats International, LLP | | x | | Audit; Compensation; Nominating & Corporate Governance |

Scot Jarvis |

|

56 |

|

1997 |

|

Principal, Cedar Grove Partners, LLC |

|

x |

|

Audit; Compensation (Chair); Nominating & Corporate Governance | | 59 | | 1997 | | Principal, Cedar Grove Partners, LLC | | x | | Audit; Compensation (Chair); Nominating & Corporate Governance |

Jane Judd |

|

70 |

|

2011 |

|

Senior Financial Executive (Ret.), Titan Corporation |

|

x |

|

Audit | | 73 | | 2011 | | Senior Financial Executive (Ret.), Titan Corporation | | x | | Audit; Compensation |

Samuel Liberatore |

|

80 |

|

2009 |

|

President (Ret.), Madison Research Division of Kratos |

|

x |

|

Nominating & Corporate Governance | | 82 | | 2009 | | President (Ret.), Madison Research Division of Kratos | | x | | Nominating & Corporate Governance |

Amy Zegart |

|

50 |

|

2014 |

|

Senior Fellow, The Hoover Institution, Stanford University and Co-Director, Stanford Center for International Security and Cooperation |

|

x |

|

Nominating & Corporate Governance (Chair) | | 52 | | 2014 | | Senior Fellow, The Hoover Institution, Stanford University and Senior Fellow, Stanford Center for International Security and Cooperation | | x | | Nominating & Corporate Governance (Chair) |

Proposal 2: Ratification of

AuditorsSelection of Independent Registered Public Accounting Firm

As a matter of good corporate governance, we are asking our stockholders to ratify the Audit Committee's selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December

31, 201727, 2020 (please review the complete Proposal No. 2 beginning on page

2322 of this proxy statement).

Proposal 3:

Employee Stock Purchase2014 Equity Incentive Plan Amendment Proposal

We are asking the Company'sCompany’s stockholders to approve an amendment to our 1999 Employee Stock Purchase2014 Equity Incentive Plan (the "Purchase Plan"“2014 Plan”) to increase the number of shares issuable under the plan by 3,000,000 shares. Such increase would enable us to continue to offer the Purchase Plan to our executive and non-executive employees. We believe key elements of our future success will be broad-based stock ownership by all of our employees and providing them with incentives to become and remain stockholders. The Purchase Plan is a broad-based employee stock purchase plan, which provides eligible

employees, including our non-executive employees, a convenient opportunity to purchase stock and further align their interests with our stockholders' interests.

Proposal 4: 2014 Equity Incentive Plan Amendment Proposal

We are asking the Company's stockholders to approve an amendment to our 2014 Equity Incentive Plan (the "2014 Plan") to increase the number of shares issuable under the plan by 2,500,000.4,700,000. Such increase would enable us to have additional shares of common stock available to attract and encourage the continued employment and service of our officers, employees, directors, and other individuals, by offering those persons the opportunity to acquire or increase a direct proprietarytheir ownership interest in our Company, operations and future success and to further align their interests with our stockholders'stockholders’ interests.

Proposal

5:4: Advisory Vote to Approve Compensation of Named Executive Officers

We

As required by Section 14A of the Exchange Act, we are asking our stockholders to provide an advisory vote relating to the compensation of our named executive officers. The Compensation Committee has developed our executive compensation strategy to achieve the following principal compensation objectives:

align executive compensation with our stockholders' interests, including placing a majority of compensation "at risk" and requiring that a significant portion of the Chief Executive Officer's and other executive management's equity awards vest in a manner that is directly tied to the Company's stock performance;

•performance and growth;recognize individual initiative and achievements and successful execution of the Company's strategic plan, as approved by the Company's Board of Directors;

•attract, motivate and retain highly qualified executives; and

•create incentives that drive the entire executive management team to achieve challenging corporate goals that drive superior long-term performance.

At the

20162019 Annual Meeting, our stockholders indicated approval of the compensation of our named executive officers, with

90.19%89.39% of the votes cast in favor of the advisory vote.

We were very pleased with the voting results in light of theThe Compensation

Committee'sCommittee and

the management's continuing efforts in gatheringour management continued to gather feedback from key stockholders regarding our executive compensation and

developingcontinued to develop a compensation structure that more closely aligns pay with performance and aligns the interests of our executives with our stockholders. We continue to regularly solicit feedback from the Company's stockholders regarding our performance, progress on executing the Company's strategic plan and our executive compensation philosophy and programs. As a result, our Compensation Committee

tookhas taken the following actions

for 2016with respect to executive compensation:

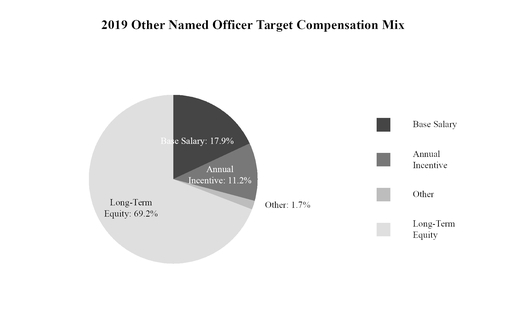

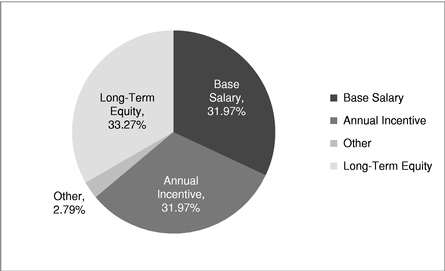

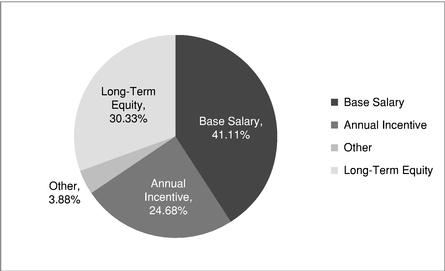

2016 2019 Executive Pay Highlights: For 2016,2019, the Compensation Committee implementedcontinued and/or continuedimplemented a number of practices that provided more clear alignment between pay and performance, including:Base Salary: In light2010, the Company’s Board of Directors approved management’s strategy to build a product, system and technology based company focused on peer and near peer threats to U.S. National Security. In 2011, the current defense industry contractionBudget Control Act of 2011(“BCA”) was established and the challenginglimited U.S. Federal Government discretionary spending, including Department of Defense ("DoD"(“DoD”) budgetary environment, the base salaries of all of our corporate named executive officers (the Chief Executive Officer and the Chief Financial Officer) and certain of our business unit executive officers remained frozen at 2014 compensation levels. This was the third base salary freeze since 2013,spending, which reflects the Compensation Committee's emphasis on aligning pay and performance, takingled to a significant U.S. defense industry contraction. Taking into consideration the continued focus ofon internal investments in certain growth opportunityopportunities and related technologies, intellectual property, and new platforms and systems that the Company has beenwas making and continues to make in its core businesses.businesses and consistent with the Company’s long term strategy, the base salaries of our Chief Executive Officer and a majority of our other executive officers remained frozen at either 2014 or 2015 compensation levels. The salary freezes reflect the Compensation Committee’s emphasis on aligning pay, execution of the previously approved long-term strategic plan of the Company and performance. The intent of the Compensation Committee wasis to construct a compensation program that continues to place significant emphasis on performance-based and long-term incentives, while being mindful of the

Long-termLong-Term Equity Incentives: Since 2013, the Company has issued an approximate 50%/50% mix (at target) of performance-based and time-based equity incentives, and the Company followed the same practice in 2016. Similar to 2015, long-term equity incentives granted in 2016 included2019. The performance-based restricted stock unit ("RSU"awards (“RSUs”) awardsgranted in 2019 provide that (a) 50% of such RSUs vest 20%based on total shareholder return (“TSR”) for every 10% increase in the closing price of the Company'sCompany’s common stock (aboverelative to the grant date priceCompany’s peers during a three-year period, and (b) 50% of $4.07) that occurs within 10 years ofsuch RSUs vest based on the grant date, provided that certain other conditions are met.Company’s Adjusted EBITDA growth during a three-year period. The time-based RSU awardsRSUs cliff vest 100% at the end of five years, which the Compensation Committee believes provides a strong long-term retention tool and long-term alignment with

stockholder interests. Additionally, the Chief Executive Officer's RSU awardsRSUs granted in 20162018 and 2019 are subject to a five-year holdingdeferral period under which the common stock underlying such RSUs will not be issued and released until five years fromafter the applicable vesting date. To further align pay and performance, in May 2016 the Compensation Committee decided that for any future RSU grants that vest based on a certain Company common stock closing price being achieved, the specified Company common stock closing price must be sustained for 20 consecutive trading days before a vesting event occurs, subject to the terms of the applicable award agreement; and the Chief Executive Officer agreed to apply such requirement retroactively to the unvested portions of his January 1, 2015 and January 4, 2016 performance-based RSU awards. In addition, the Company awarded 50,000 RSUs (which vest 33.33% on each anniversary of the date of grant) to Gerald Beaman, former President of the Company's Unmanned Systems Division, in August 2016 in recognition of the successful award to the Company of the Low Cost Attritable Strike Demonstrator ("LCASD") contract from the Air Force Research Laboratory, which was targeted as one of the critical strategic opportunities in executing the Company's unmanned combat aerial systems initiative.

•Change in Control Agreements: ContinuingThe Company continued its practice from 2013, the Compensation Committee eliminated excise tax gross-ups incommitment not to enter into any new change in control agreements that contain excise tax gross-ups and will remove any existing excise tax gross-up provisions when existing agreements are renewed or renewals or material amendments of existing change in control agreements.materially amended.

•Anti-Hedging and Anti-Pledging Policy: The Company continued its policy that prohibits any hedging and pledging transactions of the Company’s securities by directors and executive officers.

•Stock Ownership Target Guideline: The Compensation Committee continued to implement aits stock ownership target guideline for our Chief Executive Officer of 1% of our outstanding shares of common stock, including all shares held throughsubject to options, RSUs, Employee Stock Purchase Plan ("Purchase Plan") purchases, open market purchases and 401(k) holdings.

•Clawback Policy: The Compensation Committee continued its Incentive Compensation Recoupment Policy, under which the Company will seek to recover full or partial portions of cash and equity-based incentive compensation received by executive officers when such incentive compensation either (i)(a) was tied to the achievement of financial results that are subsequently restated to correct an accounting error due to material noncompliance with financial reporting requirements or (ii)and (b) would have been lower based upon the subsequently restated financial results. 2017 2020Executive Pay Highlights: For 2017,In establishing compensation for 2020, the Compensation Committee continued to focus on clear alignment between pay and performance:Base Salary: In light ofContinuing the continued defense industry contractionCompensation Committee’s emphasis on aligning pay with the Company’s long-term business strategy and the very challenging DoD budgetary environment,performance and taking into consideration the expected continued ramp in growth of the Company’s strategic core focus of internal investments inareas until a certain growth opportunity technologies and new platforms the Company has

been making and continues to make in its core businesses,critical mass is achieved, the base salaries of mostour Chief Executive Officer and a majority of our namedother executive officers (including the Chief Executive Officer) remain frozen at prior 2014 or 2015 compensation levels. This is the fourth base salary freeze since 2013, which reflects the Compensation Committee's emphasis on aligning pay and performance.

•

Long-termLong-Term Equity Incentives: The Company continued its practice of issuing an approximate 50%/50% mix of performance-based and time-based equity incentives. The Compensation Committee closely evaluated the long-term equity based incentive grants in the Company’s peer group, and made modifications for the 2020 grants to more closely align with the equity packages granted in the Company's peer group. Similar to 2016, long-term equity incentivesthe RSUs granted in 2017 includedthe prior year, 50% of the grants are performance-based RSU awards thatand 50% of the grants are time-based. The performance-based RSUs granted in January 2020 vest 20%33.3% for every 10% increasegrowth in the Company's common stock (above the grant date price of $7.51) that occurs within 10 years of the grant date; provided, that such increase in the closing price of the Company's common stock is sustained for 20 consecutive trading days and certain other conditions are met.Adjusted EBITDA over a five-year period. The time-based RSU awards cliffRSUs vest 100% at the end ofratably over five years, which the Compensation Committee believes provides a strong long-term retention tool and long-term alignment with stockholder interests. Additionally, the Chief Executive Officer's RSU awardsRSUs granted in 2017January 2020 are subject to a five-year holdingdeferral period under which the common stock underlying such RSUs will not be issued and released until five years fromafter the applicable vesting date.Stock Ownership Target Guideline: Effective January 1, 2020, to more closely align the Company’s stock ownership target guidelines with peer companies, the Compensation Committee modified its stock ownership target guideline for our Chief Executive Officer to five times his base salary.

Additional information about our compensation philosophy and program, including the compensation actions summarized above, can be found in the "Compensation Discussion and Analysis" section beginning on page 5141 of this proxy statement. Our Board of Directors and Compensation Committee believe that the compensation of our named executive officers for fiscal year 20162019 was appropriate and reasonable and that our compensation policies and procedures are sound and in the best interests of the Company and its stockholders. Additionally, the Compensation Committee believes that our compensation policies and procedures are effective in achieving the Company's goals of rewarding sustained financial and operating performance and leadership excellence, aligning the executives' long-term interests with those of our

stockholders and motivating our executive officers to remain with the Company for long and productive careers.

Proposal 6: Advisory Vote on the Frequency of the Stockholder Advisory Vote to Approve Compensation of Named Executive Officers We are asking our stockholders to provide an advisory vote on whether a non-binding stockholder vote to approve the compensation of our named executive officers should occur every one, two or three years. The Company has engaged some of its stockholders on this issue, and based on their feedback we believe that a majority of our stockholders would prefer an annual vote. Our Board of Directors is therefore recommending that stockholders vote for holding the advisory vote on executive compensation every ONE YEAR.

Cautionary Statement. Any statements in this proxy statement that do not describe historical facts may constitute forward-looking statements. These forward-looking statements are based on current expectations but are subject to a number of risks and uncertainties. The factors that could cause our actual future results to differ materially from current expectations are identified and described in more detail in our filings with the Securities and Exchange Commission (the "SEC"), including our Annual Report on Form 10-K for the fiscal year ended December 25, 2016.29, 2019. You should not place undue reliance on these forward-looking statements, which speak only as of the date that they were made. Except as required by applicable law, we do not intend to update any of the forward-looking statements to conform these statements to reflect actual results, later events or circumstances.

KRATOS DEFENSE & SECURITY SOLUTIONS, INC.

4820 EASTGATE MALL,

10680 TREENA STREET, SUITE 200

600

SAN DIEGO, CA 92121

92131

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 31, 2017JUNE 4, 2020 General

GeneralThe enclosed proxy is solicited on behalf of our Board of Directors (the "Board") for use at the 20172020 Annual Meeting of Stockholders (the "Annual Meeting") of Kratos Defense & Security Solutions, Inc., to be held on May 31, 2017June 4, 2020 at 9:11:00 a.m. local timeCDT and at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting will be held in person at the Irvine Amenities Center locatedSkirvin Hilton at 9540 Towne Centre Drive, Suite 175, San Diego, California 92121.

1 Park Avenue, Oklahoma City, OK 73102 and virtually at www.virtualshareholdermeeting.com/KTOS2020. If you plan to attend the virtual meeting, you must access the virtual meeting at www.virtualshareholdermeeting.com/KTOS2020 and use the multi-digit Control Number provided with your proxy materials to participate and submit questions.

We intend to mail a Notice Regarding the Availability of Proxy Materials (the "Notice") or our proxy materials to all stockholders of record entitled to vote at the Annual Meeting on or about April

14, 2017.24, 2020. The Notice will instruct you as to how you may access and review all of the important information contained in the proxy materials.

We intend to hold the Annual Meeting in person and virtually. However, we are actively monitoring the coronavirus (COVID-19) pandemic; we are sensitive to the public health and travel concerns our shareholders may have and the protocols that federal, state, and local governments may impose. In the event it is not possible or advisable to hold the Annual Meeting in person at the current location, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting at an alternative location or holding the meeting solely by means of remote communication. If we take this step, we will announce the decision to do so and provide information regarding how to participate in the Annual Meeting via a press release that will be posted on the “Investors” section of our website at www.kratosdefense.com and filed with the SEC as additional proxy materials.

All references to us, we, our, the Company and Kratos refer to Kratos Defense & Security Solutions, Inc., a Delaware corporation, and its subsidiaries.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on

May 31, 2017:June 4, 2020:

Our Notice of Annual Meeting of Stockholders, proxy statement and 20162019 Annual Report on Form 10-K are available at www.proxyvote.com. You are encouraged to access and review all of the important information contained in the proxy materials before voting. Solicitation and Revocation of Proxy

Our Board is soliciting the accompanying proxy. In accordance with unanimous recommendations of our Board, the individuals named in the proxy will vote all shares represented by proxies in the manner designated, or, if no designation is made, they will vote the proxies FOR the election of all of the director nominees,

and FOR each of proposals 2, 3,

4, and

5, and FOR annual say-on-pay vote frequency for proposal 6.4. In their discretion, the proxy holders named in the proxy are authorized to vote on any matters that may properly come before the Annual Meeting and at any continuation, postponement or adjournment of the Annual Meeting. As of the date of this proxy statement, our Board does not know of any other items of business that will be presented for consideration at the Annual Meeting other than those described in this proxy statement. The individuals acting as proxies will not vote on a particular matter if the proxy card representing those shares instructs them to abstain from voting on that matter or to the extent a proxy card is marked to show that some of the shares represented by the proxy card are not to be voted.

If you give a proxy, you may revoke it at any time before the final vote at the Annual Meeting, either:

(1) by attending the Annual meeting and revoking it in person or online at www.virtualshareholdermeeting.com/KTOS2020 before voting is closed at the Annual Meeting; (2) by sending a written notice that you are revoking your proxy to our Corporate Secretary at 4820 Eastgate Mall,10680 Treena Street, Suite 200,600, San Diego, California, 92121;92131; or

(3) by submitting another properly completed and executed proxy card with a later date to us at the above noted address.

Your presence at the meeting will not automatically revoke your proxy, but if you attend the meeting and cast a ballot, your proxy will be revoked as to the matters on which the ballot is cast.

Shares Outstanding and Voting Rights

Only stockholders of record as of the record date, April

7, 2017,6, 2020, will be entitled to notice of and to vote at the Annual Meeting or at any continuation, postponement or adjournment of the original meeting. On the record date, our only class of voting stock outstanding was common stock. On April

7, 2017, 86,446,0846, 2020, 106,960,828 shares of common stock were issued and outstanding. Each outstanding share of common stock entitles the holder to one vote on all matters to be voted upon at the Annual Meeting.

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote by attending the Annual Meeting and voting in

person. Youperson or virtually online through the link at www.virtualshareholdermeeting.com/KTOS2020. If you attend the meeting in person, you will be given a ballot at the Annual Meeting.

If you attend the virtual meeting, you must use the multi-digit Control Number provided with your proxy materials to submit your vote.

If you do not wish to vote

in personduring the Annual Meeting or you will not be attending the Annual Meeting, you may vote by proxy. You may vote by proxy using the enclosed proxy card, vote by proxy on the Internet or vote by proxy over the telephone. The procedures for voting by proxy are as follows:

To vote via the Internet, go to the Internet address stated on your proxy card.

•To vote by telephone, call the number stated on your proxy card.

•To vote by mail, simply mark your proxy card, date and sign it and return it in the postage-prepaid envelope.

Votes submitted via the Internet or by telephone must be received by 11:59 P.M. Eastern Time on

May 30, 2017.June 3, 2020. Submitting your proxy via the Internet or by telephone will not affect your right to vote

in person should you decide to attend the Annual

Meeting.Meeting in person or virtually online through the link at www.virtualshareholdermeeting.com/KTOS2020. If voting by mail, the proxy card must be received prior to the Annual Meeting. Even if you plan to attend the Annual Meeting, we encourage you to submit your proxy to vote your shares in advance of the Annual Meeting.

We provide Internet and telephone proxy voting with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet and telephone access, such as usage charges from Internet access providers and telephone companies.

Beneficial Owner: Shares Registered in the Name of Your Broker, Bank or Other Agent

If at the close of business on April

7, 20176, 2020 your shares of common stock were not held in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in "street name," and you will receive a proxy card and voting instructions from that organization. Your broker, bank or other nominee will allow you to deliver your voting instructions via the Internet and may also permit you to submit your voting instructions by telephone.

Please note that if your shares are held of record by a broker, bank or other nominee and you decide to attend and vote at the Annual Meeting in person, your vote in person at the Annual Meeting will not be effective unless you present a legal proxy issued in your name from your broker, bank or other nominee. If you attend the virtual meeting, you must use the multi-digit Control Number provided with your proxy materials to submit your vote.

Voting Kratos Shares Held Through the Kratos 401(k) Plan

The Kratos 401(k) Plan provides that the trustee of the plan will vote the shares of our common stock that are not directly voted by the participants in the plan. If the trustee does not receive voting instructions from participants in the Kratos 401(k) Plan, the trustee may vote the shares of our common stock under such plan in the same proportion as the shares voted by all other respective plan participants. If the trustee receives a signed but not voted proxy card, the trustee will vote such shares of our common stock according to the Board's recommendations.

Counting of Votes; Quorum

The inspector of election appointed for the meeting by our Board will count the votes cast by proxy or in person

or virtually at the Annual Meeting. The inspector will count those votes to determine whether or not a quorum is present.

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of our outstanding shares of common stock entitled to vote are represented by votes at the Annual Meeting or by proxy. At the close of business on April

7, 2017,6, 2020, the record date for the Annual Meeting, there were

86,446,084106,960,828 shares of common stock outstanding and entitled to vote at the Annual Meeting.

Your shares will be counted toward the quorum only if you submit a valid proxy (or if one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person

or virtually at the Annual Meeting. Abstentions will be counted toward the quorum requirement. Broker non-votes will also be counted toward the quorum requirement. If there is no quorum, a majority of the shares present at the Annual Meeting may adjourn the Annual Meeting to another date to provide the Company with the opportunity to establish a quorum.

The following is a summary of the voting requirements that apply to the proposals discussed in this proxy statement:

| |

| | | | |

| Proposal | ProposalVote

| | Vote

Required | | Discretionary

Voting

Allowed? |

|---|

1.

| | Discretionary Voting Allowed?

|

| 1. | Election of Directors | | Plurality | | No |

2. | | Ratification of Auditor | Selection of Independent Registered Public Accounting Firm | Majority | | Yes |

3. | | Approval of the amendment to the 1999 Employee Stock Purchase Plan | | Majority | | No |

4.

| | Approval of the amendmentAmendment to the 2014 Equity Incentive Plan

| |

Majority | | No |

5.

4. | | Advisory Vote to Approve the Compensation of Our Named Executive Officers | | Majority | | No |

6.

| | Advisory Vote on the Frequency of the Stockholder Advisory Vote on the Compensation of our Named Executive Officers

| | Plurality | | No |

Our Board unanimously recommends a vote "FOR" the election of all of the director nominees and "FOR" each of proposals 2, 3, 4, and 5, and "4.FOR" holding the advisory vote on executive compensation every "ONE YEAR" with respect to proposal 6. A "plurality" means, with regard to the election of directors, that the eightseven nominees for director receiving the greatest number of "for" votes from our shares entitled to vote will be elected. A "plurality" with regard to the advisory vote on the frequency of the stockholder vote on the

compensation of our named executive officers means that the option (every one, two or three years) receiving the greatest number of "for" votes will be considered the frequency recommended by stockholders.

A "majority" means that a proposal will pass if it receives a number of "for" votes that is a majority of the shares of common stock present in person, virtually or represented by proxy and entitled to vote at the Annual Meeting.

"Discretionary"Discretionary voting" occurs when a bank, broker, or other holder of record does not receive voting instructions from the beneficial owner and votes those shares in its discretion on any proposal as to which rules permit such bank, broker, or other holder of record to vote. As noted below, when banks, brokers, and other holders of record arenot permitted under the rules to vote the beneficial owner's shares, the affected shares are referred to as "broker non-votes."Although the advisory

votesvote on

ProposalsProposal No.

5 and 6 are4 is non-binding, as provided by law, our Board and Compensation Committee will review the results of the votes and, consistent with our record of stockholder engagement, will take the results into account in making

a determinationits determinations concerning executive

compensation and the frequency of such advisory votes.compensation.

Effect of Withhold Authority Votes, Abstentions and Broker Non-Votes

Withhold Votes: Shares subject to instructions to withhold authority to vote on the election of directors will not be voted. This will have no effect on the election of directors because, under plurality voting rules, the eightseven director nominees receiving the highest number of "for" votes will be elected. However, if any nominee for director receives a greater number of votes "withheld" than votes "for" his or her election, our corporate governance policies require that such person must promptly tender his or her resignation to the Board following certification of the vote. Any such resignation will be reviewed by our Nominating and Corporate Governance Committee and, within 90 days after the election, the Board will determine whether to accept, reject or take other appropriate action with respect to the resignation. "Withhold" votes and broker non-votes are not considered votes cast and will have no effect on the election of the nominees. Abstentions: Under Delaware law (under which Kratos is incorporated), abstentions are counted as shares present and entitled to vote at the Annual Meeting. Therefore, abstentions will have the same effect as a vote "against": Proposal No. 2—Ratification of Auditor;Selection of Independent Registered Public Accounting Firm; Proposal No. 3—Approval of the amendment to the 1999 Employee Stock Purchase Plan; Proposal No. 4—Approval of the amendmentAmendment to the 2014 Equity Incentive Plan; and Proposal No. 5—4—Advisory Vote to Approve the Compensation of our Named Executive Officers. Because the voting requirement applicable to Proposal No. 6—Advisory Vote on the Frequency of the Stockholder Advisory Vote on the Compensation of our Named Executive Officers is a plurality of the shares voted on the various options, an abstention with regard to this proposal will have no effect on the outcome of the vote. Broker Non-Votes: Under rules that govern banks, brokers and others who have record ownership of company stock held in brokerage accounts for their clients who beneficially own the shares, these banks, brokers and other such holders who do not receive voting instructions from their clients have the discretion to vote uninstructed shares on certain matters ("discretionary matters") but do not have discretion to vote uninstructed shares as to certain other matters ("non-discretionary matters"). A broker may return a proxy card on behalf of a beneficial owner from whom the broker has not received voting instructions that casts a vote with regard to discretionary matters but expressly states that the broker is not voting as to non-discretionary matters. The broker's inability to vote the non-discretionary matters with respect to which the broker hasnot received voting instructions from the beneficial owner is referred to as a "broker non-vote."

Banks, brokers, and other such record holders are not permitted to vote the uninstructed shares of their customers on a discretionary basis in the election of directors, amendments to equity plans, or on executive compensation matters. Because broker non-votes are not considered under Delaware law to be entitled to vote at the Annual Meeting, they will have no effect on the outcome of the votes on: Proposa1 No. 1—Election of Directors; Proposal No. 3—Approval of the amendment to the 1999 Employee Stock Purchase Plan; Proposal No. 4—Approval of the amendmentAmendment to the 2014 Equity Incentive Plan; and Proposal No. 5—4—Advisory Vote to Approve the Compensation of our Named Executive Officers; and Proposal No. 6—Advisory Vote on the Frequency of the Stockholder Advisory Vote on the Compensation of our Named Executive Officers. As a result, if you hold your shares in street name and you do not instruct your bank, broker, or other such holder how to vote your shares in the election of directors, on the approval of the amendment to the 1999 Employee Stock Purchase Plan, on the approval of the amendment to the 2014 Equity Incentive Plan, and on the two advisory votesvote related to the compensation of our named executive officers, no votes will be cast on your behalf on these proposals.Therefore, it is critical that you indicate your vote on these proposals if you want your vote to be counted. The proposal to ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 201727, 2020 should be considered a routine matter. Therefore, your broker will be able to vote on this proposal even if it does not receive instructions from you, so long as it holds your shares in its name.

Delivery of Notice of Internet Availability of Proxy Materials; Delivery of Multiple Proxy Materials

Under rules adopted by the SEC, we may provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials to some of our stockholders of record. If you received a Notice by mail, you will not receive a printed copy of the proxy materials unless you request one. The Notice will tell you how to access and review the proxy materials over the Internet at www.proxyvote.com. The Notice also tells you how to access your proxy card to vote over the Internet or by telephone. If you received a Notice by mail and would like to receive a printed copy of our proxy materials, please follow the instructions included in the Notice.

If you received more than one package of proxy materials, this means that you have multiple accounts holding shares of Kratos common stock. These may include: accounts with our transfer agent,

Wells FargoEQ Shareowner Services; shares held in Kratos' 401(k) Plan or

Employee Stock Purchase Plan; and accounts with a broker, bank or other holder of record. Please vote all proxy cards and voting instruction forms that you receive with each package of proxy materials to ensure that all of your shares are voted.

Cost and Method of Solicitation

We will bear the entire cost of solicitation of proxies, including preparation, assembly, printing and mailing of this proxy statement, the proxy card and any additional information furnished to our stockholders. Solicitation of proxies by mail may be supplemented by telephone or personal solicitation by our directors, officers, other employees, or consultants. No additional compensation will be paid to directors, officers or other regular employees for such services.

We have retained Georgeson Inc. to act as a proxy solicitor for a fee estimated to be $8,500, plus reimbursement of out-of-pocket expenses. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of our common stock beneficially owned by others to forward to such beneficial owners. We may reimburse such persons for their costs in forwarding the solicitation materials to such beneficial owners.

A complete list of registered stockholders entitled to vote at the meeting will be available for examination by any stockholder, for any purpose related to the meeting, for ten days prior to the date of the annual meeting during ordinary business hours at our principal offices located at 4820 Eastgate Mall,10680 Treena Street, Suite 200,600, San Diego, California, 92121.92131. The list will also be available electronically at www.virtualshareholdermeeting.com/KTOS2020 during the Annual Meeting.

Admission to the Annual Meeting

Everyone attending the Annual Meeting

in person will be required to present both proof of ownership of the Company's common stock and a valid picture identification, such as a driver's license or passport. If your shares are held in the name of a bank, broker or other financial institution, you will need a recent brokerage statement or letter from such entity reflecting your stock ownership as of the record date. If you do not have both proof of ownership of the Company's common stock and a valid picture identification, you may be denied admission to the Annual Meeting.

If you are a shareholder of record and plan to attend the Annual Meeting in person, please mark the appropriate box on the proxy card, so we can know how many people to accommodate, or enter the appropriate information when voting by telephone or Internet prior to the Annual Meeting. Cameras and electronic recording devices are not permitted at the Annual Meeting.

If you plan to attend the meeting virtually, to participate you must access the virtual meeting at www.virtualshareholdermeeting.com/KTOS2020 and use the multi-digit Control Number provided with your proxy materials. Our optional virtual meeting platform, which will be provided by Broadridge Financial Solutions, allows all participating stockholders to submit questions during the Annual Meeting. In addition, it also allows our stockholders to vote on proposals online. We believe that our virtual platform increases stockholder participation while at the same time affording the same rights and opportunities to participate, as stockholders would have at a physical annual meeting. A support number will be visible 15 minutes prior to the meeting on the virtual meeting landing page if you may need shareholder assistance.

If you need directions to the Annual Meeting so that you may attend or vote in person, please contact Kratos Defense & Security Solutions, Inc., Attention: Investor Relations,

4820 Eastgate Mall,10680 Treena Street, Suite

200,600, San Diego, California,

92121,92131, telephone (858) 812-7300.

Voting results are expected to be announced at the Annual Meeting and will also be disclosed in a Current Report on Form 8-K (the "Form 8-K") that we will file with the SEC within four business days of the date of the Annual Meeting. In the event the results disclosed in our Form 8-K are preliminary, we will subsequently amend the Form 8-K to report the final voting results within four business days of the date that such results are known.

We are committed to maintaining the highest standards of business conduct and corporate governance, which we believe are fundamental to the overall success of our business, serving our stockholders well and maintaining our integrity in the marketplace. Our Corporate Governance Guidelines and Code of Ethics, together with our certificate of incorporation, bylaws and the charters of the committees of our Board (the "Committees"), form the basis for our corporate governance framework. As discussed below, our Board has established three standing committees to assist it in fulfilling its responsibilities to the Company and its stockholders: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee.

Corporate Governance Guidelines

Our Board has adopted Corporate Governance Guidelines to assist it in the exercise of its responsibilities and to serve the interests of the Company and our stockholders. The Corporate Governance Guidelines are available for review on our website at www.kratosdefense.com/about-kratos/governance.

Our Board has unanimously determined that

sevensix of our directors standing for re-election, Messrs. Anderson,

Carano, Hoglund, Jarvis, and Liberatore and Mses. Judd and Zegart, who constitute a majority of the Board, are "independent" directors as that term is defined by NASDAQ Marketplace Rule 5605(a)(2). In making this determination, the Board has affirmatively determined, considering broadly all relevant facts and circumstances regarding each independent director, that none of the independent directors have a material relationship with us (either directly or as a partner, stockholder, officer or affiliate of an organization that has a relationship with us) that

could compromisewould interfere with the director's ability to

act independently andexercise independent judgment in

the best interests of the Company and its stockholders.carrying out his or her responsibilities as a director. In addition, based upon NASDAQ Marketplace Rule 5605(a)(2), the Board determined that Mr. DeMarco is not "independent" because he is the Company's President and Chief Executive Officer.

Nominations for Directors

The Nominating and Corporate Governance Committee is responsible for screening potential director candidates and recommending qualified candidates to the Board for nomination.

TheAs provided by our Corporate Governance Guidelines, the Nominating and Corporate Governance Committee will consider and evaluate any recommendation for director nominees proposed by a stockholder

whoor group of stockholders that has continuously held at least

1%3% of the outstanding shares of our common stock entitled to vote at the annual meeting of stockholders for at least

one yearthree years by the date the stockholder makes the recommendation and who satisfies the notice, information and consent provisions set forth in our Second Amended and Restated Bylaws, as amended (the "Bylaws"). The Nominating and Corporate Governance Committee will use the same evaluation process for director nominees recommended by stockholders as it uses for other director nominees.

In addition, our Bylaws set forth a process for stockholders to nominate individuals for election to the Board.

See "Stockholder Proposals" below for additional information regarding the content and timing of the information that must be received by our Corporate Secretary for a director nominee to be considered for election at our

20182021 Annual Meeting. A printed copy of our Bylaws may be obtained by any stockholder upon request to our Corporate Secretary at Kratos Defense & Security Solutions, Inc.,

4820 Eastgate Mall,10680 Treena Street, Suite

200,600, San Diego, California

92121.92131.

The goal of the Nominating and Corporate Governance Committee is to assemble a board of directors that brings a variety of perspectives and skills derived from high quality business and

professional experience to Kratos. As stated in our Corporate Governance Guidelines, nominees for director are to be selected on the basis of, among other criteria, experience, knowledge, skills, expertise, integrity, absence of conflicts of interests with the Company, diversity, ability to make analytical inquiries, understanding of or familiarity with our business, products or markets or similar businesses, products or markets, and willingness to devote adequate time and effort to Board responsibilities. Although we do not have a written policy with respect to Board diversity, the Nominating and Corporate Governance Committee and the

Board believe that a diverse board leads to improved Company performance by encouraging new ideas, expanding the knowledge base available to management and fostering a boardroom culture that promotes innovation and vigorous deliberation.

Additionally, our Bylaws provide that in order to be eligible for election or appointment to the Board, an individual must (i) be at least 21 years of age, (ii) have the ability to be present, in person, at all regular and special meetings of the Board, and (iii) either (a) have substantial relevant experience in the national defense and security industry or (b) have, or be able to obtain, a U.S. government issued security clearance relevant to the business of the corporation. In addition to the foregoing, no person shall be eligible for election or appointment to the Board if such person has been convicted of a crime involving dishonesty or breach of trust or if such person is currently charged with the commission of or participation in such a crime. The Nominating and Corporate Governance Committee may also consider such other factors as it may deem are in Kratos' best interests and that of our stockholders. The Nominating and Corporate Governance Committee does, however, recognize that under applicable regulatory requirements at least one member of our Board must meet the criteria for an "audit committee financial expert" as defined by SEC rules,

and that at least a majority of the members of our Board must meet the definition of "independent director" under the NASDAQ Marketplace Rules or the listing standards of any other applicable self- regulatory

organization.organization, and that there must be at least one female member of our Board as required by California Senate Bill 826. The Nominating and Corporate Governance Committee also believes it to be appropriate for certain key members of our management to participate as members of our Board.

The Nominating and Corporate Governance Committee identifies nominees by first evaluating the current members of our Board willing to continue to serve. Current members of our Board with skills and experience that are relevant to our business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of our Board with that of obtaining a new perspective. If any member of our Board does not wish to be considered for re-election at an upcoming annual meeting of stockholders, the Nominating and Corporate Governance Committee identifies the desired skills and experience of a new nominee in light of the criteria above. In such cases, all of the members of our Board are polled for suggestions as to individuals meeting the criteria for nomination to our Board. Research may also be performed to identify qualified individuals. If the Nominating and Corporate Governance Committee believes that our Board requires additional candidates for nomination, it may explore alternative sources for identifying additional candidates. This may include engaging, as appropriate, a third party search firm to assist in identifying qualified candidates.

All directors and director nominees are required to submit a completed directors' and officers' questionnaire as part of the nominating process. At the discretion of the Nominating and Corporate Governance Committee, the nominating process may also include interviews and additional background and reference checks for non-incumbent nominees.

Stockholder Communications with Directors

The Board has adopted a Stockholder Communications with Directors Policy. The Stockholder Communications with Directors Policy is available for review on our website at www.kratosdefense.com/about-kratos/governance. Stockholders and other interested parties may communicate with one or more members of the Board or the non-management directors as a group in writing by regular mail. Those who wish to send such communications may do so by addressing their

communication to: Chairman of the Board or Board of Directors, c/o Corporate Secretary, Kratos Defense & Security Solutions, Inc., 4820 Eastgate Mall,10680 Treena Street, Suite 200,600, San Diego, California 92121.

92131.

The Board has instructed the Corporate Secretary to review all communications so received and to exercise

hisher discretion not to forward to the Board correspondence that is inappropriate such as business solicitations, frivolous communications and advertising, routine business matters and personal grievances. However, any director may at any time request the Corporate Secretary to forward any and all communications received by the Corporate Secretary but not forwarded to the directors.

Our Board has adopted a Code of Ethics that applies to all of our directors, officers and employees. The Code of Ethics is available for review on our website at www.kratosdefense.com/about-kratos/governance and is also available in print, without charge, to any stockholder who requests a copy by writing to us at Kratos Defense & Security Solutions, Inc., 4820 Eastgate Mall,10680 Treena Street, Suite 200,600, San Diego, California, 92121,92131, Attention: Investor Relations. Each of our directors, employees and officers, including our Chief Executive Officer, Chief Financial Officer and Corporate Controller, and all of our other Principal Executive Officers, are required to comply with the Code of Ethics. The Audit Committee is responsible for reviewing and approving all amendments to the Code of Ethics and all waivers of the Code of Ethics for executive officers or directors and providing for prompt disclosure of all amendments and waivers required to be disclosed under applicable law. We will disclose future amendments to our Code of Ethics or waivers required to be disclosed under applicable law from our Code of Ethics for our Principal Executive Officer, Principal Financial Officer, Principal Accounting Officer or Controller, and our other executive officers and ouror directors on our website,www.kratosdefense.com, within four business days following the date of the amendment or waiver. There have not been any waivers of the Code of Ethics relating to any of our executive officers or directors in the past year. Meetings and Committees of the Board

Our Board is responsible for overseeing the management of our business. We keep our directors informed of our business at meetings and through reports and analyses presented to the Board and the Committees. Regular communications between our directors and management also occur apart from meetings of the Board and the Committees.

Our Board normally meets quarterly but may hold additional meetings as required. During fiscal year

2016,2019, the Board held four regularly scheduled meetings,

oneand two special

meeting and acted by unanimous written consent one time.meetings. Each of our directors attended

at least 75%

or more of the aggregate of the total number of Board meetings and the total number of meetings of each Committee on which he or she was serving. All

eightseven of our directors attended last year's annual meeting of stockholders.

Our Board has adopted a "Board Member Attendance at Annual Meetings Policy," which strongly encourages all directors to attend the Company's annual meetings of stockholders. The full policy is available for review on our website at www.kratosdefense.com/about-kratos/governance.

Executive sessions of independent non-employee directors are held in connection with each regularly scheduled Board meeting and at other times as necessary, and are chaired by our Chairman of the Board. The Board's policy is to hold executive sessions without the presence of management, including the Chief Executive Officer and other non-independent directors, if any. The Committees of our Board may also meet in executive session at the end of each Committee meeting. Executive sessions of the Audit Committee and Compensation Committee are routinely held with the regularly scheduled meetings of the respective committees.

Committees of the Board

Our Board currently has three standing

Committeescommittees to facilitate and assist the Board in the execution of its responsibilities: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee.

Our Audit Committee consists of Messrs. Anderson (Chairperson), Hoglund and Jarvis and Ms. Judd. Our Board has affirmatively determined that each member of the Audit Committee is independent under NASDAQ Marketplace Rule 5605(a)(2) and meets the independence and all other qualifications under NASDAQ Marketplace Rule 5605(c), the Sarbanes-Oxley Act of 2002 (the "Sarbanes-Oxley Act") and applicable rules of the SEC. Our Board has also affirmatively determined that Ms. Judd qualifies as an "audit committee financial expert" as such term is defined in Regulation S-K under the Securities Act of 1933, as amended. During

2016,2019, the Audit Committee met

sixseven times.

The Audit Committee acts pursuant to a written charter, which is available for review on our website at www.kratosdefense.com/about-kratos/governance. The responsibilities of the Audit Committee include overseeing, reviewing and evaluating our financial statements, accounting and financial reporting processes, internal control functions and the audits of our financial statements. The Audit Committee is also responsible for the appointment, compensation, retention, and as necessary, the termination of our independent auditors. Additional information regarding the Audit Committee is set forth below in the Report of the Audit Committee.

Our Compensation Committee consists of

Messrs. Carano,Messrs, Hoglund and Jarvis (Chairperson)

. and Ms. Judd. Our Board has affirmatively determined that each member of the Compensation Committee is independent as such term is defined under NASDAQ Marketplace Rule 5605(a)(2) and meets the independence and all other qualifications under NASDAQ Marketplace Rule 5605(d). During

2016,2019, the Compensation Committee

formally met four

times.times and has had further additional discussions as they deem appropriate. Our Board has adopted a charter for the Compensation Committee, which is available for review on our website at www.kratosdefense.com/about-kratos/governance. The Compensation Committee reviews and makes recommendations to our Board concerning the compensation and benefits of our executive officers (including the Chief Executive Officer) and directors, oversees the administration of our

stock optionequity and employee benefits plans, and reviews general policies relating to compensation and benefits. In accordance with NASDAQ Marketplace Rule 5605(d), the Compensation Committee evaluates the independence of each compensation consultant, outside counsel and advisor retained by or providing advice to the Compensation Committee. The Compensation Discussion and Analysis section below provides additional information regarding the Compensation Committee's processes and procedures for considering and determining executive compensation.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of Ms. Zegart (Chairperson) and Messrs. Anderson, Hoglund, Jarvis and Liberatore. Our Board has affirmatively determined that each member of the Nominating and Corporate Governance Committee is independent as such term is defined under NASDAQ Marketplace Rule 5605(a)(2). The Nominating and Corporate Governance Committee evaluates and recommends to the Board nominees for each election of directors. The Nominating and Corporate Governance Committee met

fourfive times in

2016.2019. Our Board has adopted a charter for the Nominating and Corporate Governance Committee, which is available for review on our website at www.kratosdefense.com/about-kratos/governance. The responsibilities of the Nominating and

Corporate Governance Committee include making recommendations to the Board with respect to the nominations or elections of directors and providing oversight of our corporate governance policies and practices.

Board and Committee Effectiveness

The Board and each of its Committees perform an annual self-assessment to evaluate their effectiveness in fulfilling their obligations. The Board and Committee evaluations cover a wide range of topics, including, among others, the fulfillment of the Board and Committee responsibilities identified in the Corporate Governance Guidelines and charters for each Committee.

Board Leadership Structure

The Board believes that its current independent Board structure is best for our Company and provides good corporate governance and accountability. The Board does not have a fixed policy regarding the separation of the roles of the Chairman of the Board and the Chief Executive Officer because it believes the Board should be able to freely select the Chairman of the Board based on criteria that it deems to be in the best interests of the Company and its stockholders. The functions of the Board are carried out by the full Board, and when delegated, by the Committees. Each director is a full and equal participant in the major strategic and policy decisions of our Company.

The Board believes that the current structure of a separate Chairman of the Board and Chief Executive Officer is the optimum structure for the Company at this time, taking into consideration Mr. DeMarco's active role in pursuing the Company's business and strategic plans.

Board Role in Risk Management

The risk oversight function of the Board is carried out by both the Board and each of its Committees, with the primary responsibility for identifying and managing risk at the Company resting with senior management. While the risk oversight function and matters of strategic risk are considered by the Board as a whole, each of the Committees has the following risk oversight responsibilities:

As provided in its charter, the Audit Committee meets periodically with management to discuss our major financial and operating risk exposures and the steps, guidelines and policies taken or implemented relating to risk assessment and risk management. Each quarter, our head of Internal Audit has reported directly to the Audit Committee on the activities of our internal audit function and at least annually our General Counsel reports directly to the Audit Committee on our ethics and compliance program. Management also reports to the Audit Committee on legal, finance, accounting and tax matters at least quarterly. The Board is provided with reports on legal matters at least quarterly and on other matters related to risk oversight on an as-needed basis.

• The Audit Committee typically also has executive meetings with the internal auditors and external auditors without senior management.As provided in its charter, the Nominating and Corporate Governance Committee considers risks related to regulatory and compliance matters.

•As provided in its charter, the Compensation Committee considers risks related to the design of the Company's compensation programs for our executives.

Compensation Committee Interlocks and Insider Participation

During fiscal year 2016,2019, no members of our Compensation Committee were officers or employees of Kratos or any of our subsidiaries or had any relationship otherwise requiring disclosure hereunder. In addition, none of our executive officers serves on the board of directors or compensation committee of a company that has an executive officer that serves on our Board or our Compensation Committee.

Certain Relationships and Related Party Transactions

None of our directors are a party to any agreement or arrangement relating to compensation provided by a third party in connection with their service on the Board that would be required to be disclosed pursuant to NASDAQ Rule 5250(b)(3).

During fiscal year

2016,2019, the Company

paid $1,948,078 toincurred $3,993,722 from one of its suppliers, 5-D Systems, Inc. ("5-D") for engineering services rendered to its Unmanned Systems

business unit.Division. Steve Fendley,

who was promoted in January 2017 tothe President of our Unmanned Systems Division, is a cofounder and